The Basic Principles Of Ach Processing

Table of ContentsAch Processing Fundamentals ExplainedNot known Details About Ach Processing The 8-Minute Rule for Ach ProcessingRumored Buzz on Ach ProcessingThe Best Guide To Ach Processing

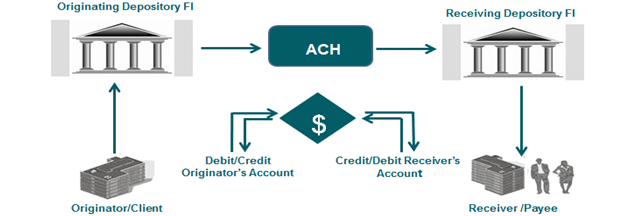

Straight repayments can be utilized by people, companies, and other companies to send cash. If you're paying a bill online with your financial institution account, that's an ACH direct repayment.This debit shows to whom the cash was paid as well as for what quantity. The individual or entity getting the cash registers it in their financial institution account as an ACH credit history. The former pulls cash from an account while the latter pushes it to one more account. Utilizing ACH transfers to pay expenses or make person-to-person repayments provides several advantages, beginning with convenience.

As well as you can conserve on your own a couple of bucks by not needing to spend cash on stamps. In enhancement, an ACH payment can be a lot more secure than other forms of repayment. Sending out and obtaining ACH settlements is normally fast. The negotiation of a transaction, or the transfer of funds from one financial institution to one more using the ACH Network, usually happens the next day after it is initiated.

Everything about Ach Processing

Cable transfers are known for their speed and are frequently utilized for same-day solution, but they can in some cases take longer to complete., for instance, it might take several company days for the money to relocate from one account to another, then one more couple of days for the transfer to clear.

There are some potential disadvantages to bear in mind when using them to move money from one financial institution to an additional, send settlements, or pay expenses. Numerous financial institutions impose limitations on how much money you can send out by means of an ACH transfer. There might be per-transaction restrictions, daily limits, as well as monthly or weekly limits.

The smart Trick of Ach Processing That Nobody is Discussing

Or one sort of ACH purchase might be endless however an additional may not. Financial institutions can also impose limitations on transfer locations. As an example, they might restrict international transfers. Interest-bearing accounts are see this here regulated by Federal Book Policy D, which may limit particular kinds of withdrawals/transfers to 6 per month. If you review that limitation with numerous ACH transfers from cost savings to another bank, you can be struck with an excess withdrawal fine.

When you select to send out an ACH transfer, the time framework issues. That's due to the fact that not every bank sends them for financial institution processing at the very same time. There may be a cutoff time by which you require to get your transfer in to have it refined for the next organization day.

Same-Day ACH handling is growing in order to solve the slow service of the basic ACH system. Same-Day ACH volume rose by 73.

The 9-Minute Rule for Ach Processing

An ACH bank transfer is an get redirected here electronic settlement made between financial institutions for payment functions. ACH bank transfers are used for many functions, such as straight deposits of incomes, financial debts for routine payments, as well as cash transfers.

ACH transfers typically take longer to complete; nevertheless, same-day ACH transfers are becoming a lot more typical. ACH is additionally for residential transfers whereas worldwide transfers are done by wire transfers.

The Basic Principles Of Ach Processing

Either way, make certain you recognize your financial institution's policies for ACH straight down payments as well as straight settlements. Additionally, be vigilant for ACH transfer scams. A common rip-off, for example, involves a person sending you an e-mail informing you that you're owed cash, as well as all you require to do to obtain it is supply your financial institution account number and directing number.

Editor's note: This article was very first published April 29, 2020 and last updated January 13, 2022 ACH means Automated Cleaning Home, a united state economic network utilized for digital repayments and also money transfers. Recognized as "direct repayments," ACH payments are a means to transfer cash from one bank account to one more without making use of paper checks, credit score card networks, wire transfers, or cash money.

As a customer, it's most likely you're currently familiar with ACH repayments, also though you may not be mindful of the lingo. If you pay your costs electronically (instead of writing a check or entering a credit score card number) or get straight deposit from your company, the ACH network is probably at work.